6 Lessons, Mises (EN)

Recently the UFC star Renato Moicano urged fans to read Mises 6 Lessons, and praised private property and the Austrian economist teachings. What are exactly the 6 Lessons?

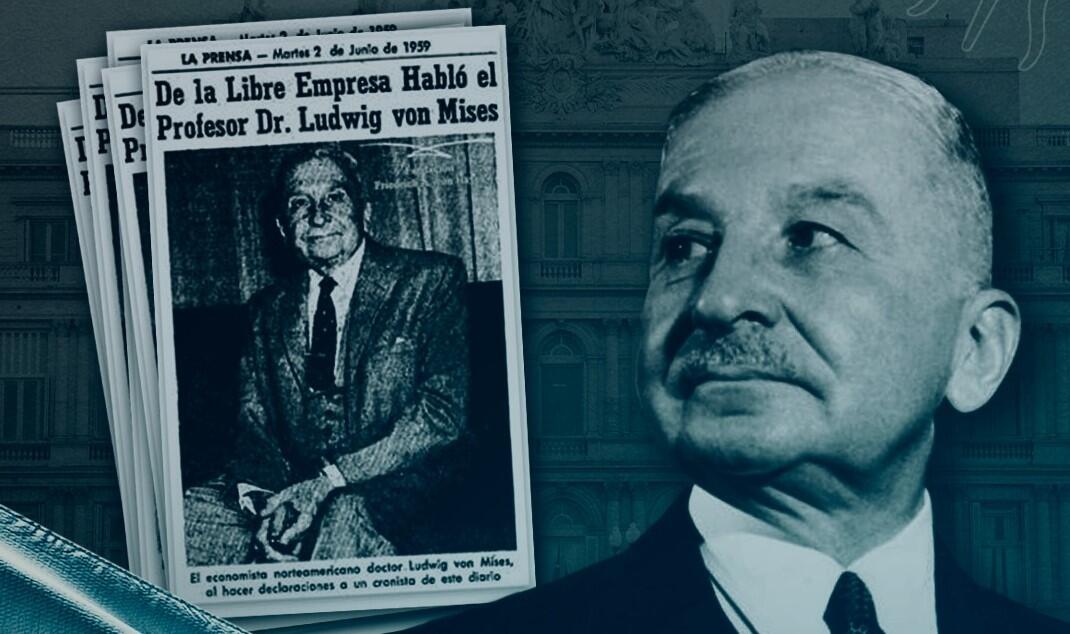

"Economic Policy: Thoughts for Today and Tomorrow" consists of a series of six lectures delivered by Ludwig von Mises in Buenos Aires, Argentina, in 1959. The lectures were given over a series of nights to audiences comprising businessmen, students, and other professionals interested in economic theories and policies. These lectures encapsulate Mises’s robust defense of free-market economics and critique of interventionist and socialist policies, distilled into accessible and persuasive discourses aimed at a general audience, not just academics.

The lectures were later compiled and published into a book by Mises’s wife, Margit von Mises. Margit played a pivotal role in preserving and promoting her husband's legacy, particularly after his death. She not only managed his papers but also ensured that his lectures and unpublished works were accessible to the public. Her efforts were instrumental in compiling these lectures into the book format, making Mises's ideas available to a broader audience beyond those who were able to attend the lectures in person.

Margit von Mises’s contribution to the preservation and dissemination of Ludwig’s work was crucial, especially considering the contextual and historical importance of these lectures. The book not only serves as a record of Mises's thought processes at that time but also provides insights into the practical applications of his economic philosophies against the backdrop of the global economic conditions of the mid-20th century.

Significance and Impact

The publication of these lectures in book form has significantly impacted the field of economics, particularly among proponents of the Austrian School of economic thought, of which Mises was a leading figure. By addressing complex economic issues in a straightforward manner, Mises made the principles of the Austrian School accessible to a wider audience, enhancing the understanding and appreciation of market mechanisms and individual-based economics.

Contemporary Relevance

Today, "Economic Policy: Thoughts for Today and Tomorrow" remains a relevant and influential work. It is often cited in discussions around economic policies, especially in debates concerning the merits and drawbacks of capitalism versus more controlled economic systems. The book serves as both a historical document and a continuing source of economic philosophy that champions individual liberty and free-market principles.

Lecture 1: Capitalism

This lecture articulates a compelling defense of capitalism, which Mises defines as a system characterized by private ownership of the means of production, voluntary exchange, and competition. This perspective builds on his foundational work in "Human Action," where he conducts a thorough analysis of human action and its pivotal role in shaping economic systems. Mises champions capitalism as the optimal framework for individuals to freely pursue their personal and economic interests, unimpeded by government intervention or coercion.

Mises argues that capitalism's foremost advantage is its propensity to drive economic growth. By nurturing an environment ripe for voluntary exchange and competition, capitalism serves as a catalyst for innovation and entrepreneurship. This, in turn, leads to heightened productivity and economic expansion. Moreover, capitalism bolsters individual freedom and autonomy, empowering people to chase their aspirations without state interference.

Nevertheless, Mises acknowledges and addresses several criticisms of capitalism. For instance, in response to claims that capitalism engenders inequality, he argues that differences in intelligence, talent, and effort are inherent to humanity. He contends that efforts to equalize outcomes are misguided and instead advocates for policies that foster economic growth and mobility, enabling individuals to advance through their own endeavors.

Mises also rebuts the notion that capitalism perpetuates exploitation, where the wealthy allegedly exploit the poor. He maintains that voluntary exchange is mutually consensual and that market prices genuinely reflect the value consumers place on goods and services. This viewpoint fundamentally contradicts the idea that capitalists exploit workers, instead underscoring the reciprocal benefits of exchange.

Furthermore, Mises addresses concerns that capitalism inherently leads to monopolies, which could stymie competition and innovation. He argues that fostering competition through deregulation and the protection of property rights can enable new entrants to challenge established firms and spur innovation.

In conclusion, Mises's work robustly defends capitalism, highlighting its capacity to stimulate economic growth and promote individual liberty. As we delve deeper into the Austrian School's principles, we'll further explore human action, economics, and government's role in economic outcomes. By examining Mises's responses to criticisms of capitalism, we gain a deeper appreciation for this economic system's advantages and the critical need to curtail government intervention in the economy.

Lecture 2: Socialism

In this lecture, Ludwig von Mises offers a rigorous critique of socialism, an economic system where private ownership of the means of production is replaced by state or collective ownership. Mises argues that socialism, despite its goal of achieving social equality through wealth redistribution, invariably leads to numerous inefficiencies and issues.

Key Failures of Socialist Systems:

- Lack of Incentives: Mises points out that without the motivations provided by private ownership and profit potential, individuals have little impetus to innovate or improve efficiency. This lack of personal stake in the outcomes can lead to stagnation and a decline in productivity.

- Problems with Central Planning: Central planning, a common feature of socialist economies, often results in resource misallocation. Planners lack the localized knowledge that market signals provide, leading to inefficient production processes and general productivity declines.

- Suppression of Freedom: Socialism’s elimination of private property and market mechanisms not only undermines individual autonomy but also limits personal freedom, as economic choices become heavily regulated by the state.

Historical Evidence

Mises utilizes historical examples to substantiate his critique. He references the economic hardships faced by the Soviet Union under socialist governance, which were characterized by widespread inefficiencies and shortages. He also critiques the nationalization efforts in European countries during World War II, which he argues led to economic stagnation and reduced growth.

Bureaucratic Inefficiencies

According to Mises, socialism’s focus on collective ownership and central planning results in excessive bureaucracy, which can hinder decision-making and innovation. The focus on meeting arbitrary production targets, rather than responding to market demands, often results in outdated or inefficient production processes.

Through his critique of socialism, Mises underscores the critical importance of private property, individual freedom, and market mechanisms in fostering economic prosperity and human development. By examining the theoretical underpinnings, criticisms, and empirical failures of socialism, we gain a clearer understanding of the potential pitfalls of collectivist economic systems and the benefits of limiting governmental control over the economy.

Contrasting Capitalism:

Mises contrasts these issues with the benefits of capitalism, as outlined in his previous lecture, emphasizing that the freedoms and efficiencies inherent in a market economy lead to better outcomes for individual and societal wealth and well-being. As we continue to explore the Austrian School's ideas, the principles of human action, economics, and the minimal role of government in economic affairs become increasingly evident, highlighting the advantages of individual freedom and market-based mechanisms in promoting economic prosperity and human flourishing.

Lecture 3: Interventionism

In this lecture, Mises explains interventionism as an economic system where the government oversteps its essential roles—protecting property and preventing fraud—to meddle in market operations like prices, wages, interest rates, and profits. According to Mises, this approach is deeply flawed, forcing entrepreneurs to make decisions that deviate from those they would choose in a market governed solely by consumer preferences.

Consequences of Interventionism:

Mises outlines several detrimental effects of interventionism on the economy:

- Economic Instability: Government manipulation of the money supply and credit can lead to inflation, which undermines the value of money and creates economic cycles of booms and busts. These cycles disrupt business planning and investment, as companies cannot predict future economic conditions reliably.

- Stifled Innovation: By restricting market forces, interventionism curtails individual creativity and innovation. When the government dictates economic actions, it reduces the incentive for businesses to innovate and respond agilely to market demands.

- Inefficiency and Waste: Interventionist policies often lead to misallocated resources and inefficiencies in production. Government planners lack the localized knowledge that entrepreneurs and markets naturally use to allocate resources most effectively.

Historical Examples:

Mises uses specific historical instances to illustrate his points:

- He cites the interventionist policies of the 1920s and 1930s, such as the Federal Reserve’s monetary policies and the Smoot-Hawley Tariff Act, as exacerbating the Great Depression.

- He references Germany's hyperinflation after World War I, triggered by excessive government spending and money creation, as a stark warning of interventionism's risks.

Through this critique, Mises underscores the necessity of limiting government intervention and allowing free-market mechanisms to operate. He posits that the health of an economy and the prosperity of its society hinge on the extent to which free markets are permitted to function without government interference.

Mises's insights into the dangers of interventionism are profoundly relevant today. By understanding these pitfalls, we can appreciate the virtues of a market economy and recognize the importance of restraining governmental overreach in economic affairs.

Lecture 4: Inflation

In this lecture, Mises offers a comprehensive exploration of inflation, identifying it as a primarily monetary phenomenon with profound economic and societal impacts. He asserts that the central cause of inflation is the excessive expansion of the money supply by central banks, which introduces new purchasing power into the economy that is not matched by an increase in production. This discrepancy leads to price increases as consumers rush to spend their new wealth.

Mises also points out additional contributors to inflation, such as excessive government spending, borrowing, and expansionary fiscal policies like tax cuts or increased government expenditures. These actions can further stimulate demand and exacerbate price rises, leading to inflation.

The ramifications of inflation, according to Mises, are severe and far-reaching. It undermines the value of savings, complicating individuals’ financial planning and goal achievement. Inflation also injects uncertainty into economic planning, making it challenging for businesses to make informed investment decisions as future prices become unpredictable. Additionally, inflation can distort resource allocation, prompting individuals and businesses to prioritize short-term gains over long-term productivity.

To combat inflation, Mises recommends several measures:

- Monetary Discipline: Central banks should exercise restraint and avoid excessive expansion of the money supply.

- Gold Standard: Adopting a gold standard could restrict central banks' ability to print money indiscriminately, thus controlling inflation.

- Fiscal Responsibility: Governments need to curtail their spending to prevent fueling inflation further.

- Indexation of Wages and Contracts: Implementing mechanisms that adjust wages and contracts to reflect inflation can help mitigate its impacts.

In conclusion, Mises's discussion on inflation underscores the necessity of maintaining monetary discipline and embracing sound fiscal policies to ensure economic stability. His recommendations aim to shield economies from the disruptive effects of inflation and emphasize the importance of a stable currency in fostering economic prosperity.

Lecture 5: Foreign Investment

In this lecture, Ludwig von Mises emphasizes the crucial role of foreign investment in stimulating economic growth and development. He views foreign investment as an essential means of bringing in new technologies, management expertise, and capital, which collectively can enhance local industries and propel economic expansion.

Mises argues that host countries reap significant benefits from foreign investment. These include access to cutting-edge technologies and management practices that can boost productivity and competitiveness. Additionally, the influx of capital from foreign investors helps to create jobs, stimulate local industries, and accelerate economic growth.

To maximize the benefits of foreign investment, Mises advocates for a set of policies centered on economic liberalization and minimal governmental interference. He champions free trade as a mechanism for allowing goods and services to move across borders unimpeded, which fosters specialization and increases efficiency. Capital freedom is also critical, according to Mises, as it permits investors to pursue the most profitable opportunities, thus optimizing resource allocation. Moreover, he stresses the importance of robust property rights to ensure that foreign investors are neither expropriated nor burdened by arbitrary regulations.

Mises's analysis also touches on the potential drawbacks of poorly managed foreign investment, such as overdependence on external capital and the possible erosion of local industries. However, he maintains that these risks can be mitigated through wise policy choices that prioritize economic freedom and a welcoming business environment.

In conclusion, Mises's lecture on foreign investment underscores its importance as a driver of economic growth and an enhancer of competitiveness in the global market. By adopting policies that encourage free trade, capital mobility, and strong property rights, countries can effectively harness the potential of foreign investment to improve their economic standing and the quality of life for their citizens. As we continue exploring the Austrian School's ideas, we appreciate more deeply the profound impact of liberal economic policies on fostering prosperity and development.

Lecture 6: Policies and Ideas

In this concluding lecture, Ludwig von Mises synthesizes the core principles of his economic philosophy, consistently advocating for a laissez-faire approach. He emphasizes the primacy of individual freedom and market mechanisms in guiding efficient resource allocation and economic stability.

Mises firmly opposes interventionism, which he views as a precursor to economic instability and inefficiency. Instead, he champions monetary discipline and a gold standard to prevent inflation and promote stability. His advocacy extends to free trade and the staunch protection of property rights, which he argues are indispensable for fostering economic growth and development.

Central to Mises's discourse is the impact of ideas and ideology on economic policy. He warns that economic policies are often shaped more by ideological predispositions than by empirical evidence. He posits that the propagation of flawed ideas can lead to dire economic outcomes, whereas sound ideas can significantly enhance economic prosperity.

Looking ahead, Mises envisions a global economy liberated from excessive government intervention, where free markets are the primary drivers of resource allocation. He calls for the reinstatement of the gold standard to curtail monetary manipulation and advocates for unfettered international trade. Above all, Mises underscores the importance of upholding individual freedoms and minimal governmental interference in economic activities.

Through this lecture, Mises articulates a clear vision for future economic policies rooted in classical liberal principles. His teachings emphasize the enduring importance of individual liberty, market efficiency, and minimal state intervention, providing a cogent blueprint for economic liberalization and the safeguarding of personal and economic freedoms.

Conclusion

Through his influential lectures compiled in "Economic Policy: Thoughts for Today and Tomorrow," Ludwig von Mises provides a rigorous exploration of economic principles, offering a profound case for the importance of individual freedom, market dynamics, and minimal government intervention. His insights continue to resonate, shaping modern economic policy and classical liberal thought.

Economic Methodology: In his first lecture, Mises stresses the importance of logical reasoning and real-world evidence over abstract mathematical models, which he believes often fail to capture the nuances of economic behavior. His emphasis on theoretical frameworks and conceptual analysis seeks to ground economic thinking in reality rather than in idealized equations.

Human Action: The concept of human action, introduced in the second lecture, forms the cornerstone of Austrian economics. Mises argues that economics is fundamentally about individuals acting out of self-interest, making decisions independently of government or collective market forces. This perspective underscores the significance of personal autonomy and voluntary exchanges in a healthy economy.

Market Process: In discussing the market process, Mises highlights how entrepreneurial spirit and competition are critical for innovation and economic development. The dynamic adjustment of prices in response to supply and demand signals facilitates this process, driving societal advancements and increased welfare.

Inflation: The fourth lecture deals with inflation, which Mises identifies as a destructive outcome of central banks' interference in the money supply. He vividly illustrates how inflation undermines savings, fosters uncertainty, and results in the poor allocation of resources, contributing to broader economic malaise.

Foreign Investment: Mises champions foreign investment as a catalyst for economic progress in his fifth lecture. By advocating for open trade and minimal regulatory barriers, he underscores how international capital flows can bring about technological advancement, management expertise, and overall economic growth.

Policies and Ideas: Finally, Mises delves into the profound impact of ideological underpinnings on economic policy. He promotes a laissez-faire economic policy, arguing vigorously against interventionism and in favor of policies that protect individual liberties and foster market-led resource allocation.

In summary, Mises's lectures articulate a compelling vision for economic policy that privileges individual agency, market processes, and a restrained role for government. His work not only critiques prevalent economic systems like socialism and interventionism but also lays a robust intellectual foundation for advocating free markets and individual rights. As we continue to face economic and political challenges today, the timeless relevance of Mises's ideas offers valuable insights into fostering environments that encourage economic stability, growth, and human flourishing.